What is Forex Technical Analysis?

Forex Technical Analysis is the method of performing technical Analysis of Forex Market. This analysis is done for those who trades currencies like International Banks, Institutional Investors, Commercial Companies, Governments and other financial institutions. Forex Market is said to be the most liquid financial market in the world. So, Technical Analysis of Forex Market is extremely vital and holds high degree of significance.

Significance of Forex Technical Analysis -

- Technical analysis and fundamental analysis differ greatly, but both can be useful forecast tools for the Forex trader. They have the same goal – to predict a price or movement. The technical analyst studies the effect while the fundamentalist studies the cause of market movement. Many successful traders combine a mixture of both approaches for superior results.

- The importance of Forex Technical Analysis is very crucial. The reason is simple. That Forex Market is said to be the most liquid financial market in the world. Other reason is Technical Analysis provides true signals upon which one can act and provide forecasting. It also eliminates the biggest enemy of Forex Traders "The Gut Feeling".

- Forex traders use fundamental analysis to view currencies and their countries like companies, thereby using economic announcements to gain an idea of the currency's true value.

- Forex traders use technical analysis to look at currencies the same way they would any other asset and, therefore, use technical tools such as trends, charts and indicators in their trading strategies.

- One of the underlying tenets of technical analysis is that historical price action predicts future price action. Since the Forex is a 24-hour market, there tends to be a large amount of data that can be used to gauge future price activity, thereby increasing the statistical significance of the forecast. This makes it the perfect market for traders that use technical tools, such as trends, charts and indicators.

Forex Technical Analysis Summary Chart-

| Symbol | Type | 5 Minutes | 15 Minutes | Hourly | Daily |

|---|

EUR/USD

1.3746

| Moving Averages: | Strong Sell | Strong Sell | Strong Sell | Sell |

| Indicators: | Strong Sell | Strong Sell | Strong Sell | Strong Sell |

| Summary: | Strong Sell | Strong Sell | Strong Sell | Strong Sell |

GBP/USD

1.6628

| Moving Averages: | Strong Sell | Strong Sell | Neutral | Strong Buy |

| Indicators: | Strong Sell | Strong Sell | Strong Sell | Strong Buy |

| Summary: | Strong Sell | Strong Sell | Sell | Strong Buy |

The chart depicts Technical Analysis Summary of Currencies indicating "Strong Sell" and "Strong Buy" This way Forex Traders can trade effectively.

Forex Technical Analysis Strategies -

Basically, trading strategy is a set of entry and exit rules, which a trader can use to open and close positions in the foreign exchange market. This rules can be very simple or very complex. Simple strategies usually require only few confirmations, while advanced strategies may require multiple confirmations and signals from different sources.

Additionally, a trading strategy may contain some money management rules or guidelines.

Apart from the entry/exit rules and optional money management guidelines, strategies are often characterized by the list of trading tools required to employ the given strategy. These tools are usually charts, technical or fundamental indicators, some market data or anything else that can be used in trading. When choosing a strategy, you need to understand, which of the required tools you have in possession.

1. Identify the type of the market and the type of the trade

The first step in technical analysis must be the identification of the market with which the trader is interacting. After that he must determine the time period of the trade he will enter. What kind of charts will the trader use for his trade? Will it be a monthly trade, or an hourly one? If it’s a monthly trade, there’s no need to worry about the hourly changes in the price, provided that the strategy regards the present value as an acceptable monthly entry or exit point. Conversely, if the trade is for the short term, the trader may desire to examine charts of longer periods to gain an understanding of the bigger picture which may guide him with respect to his stop loss or take profit orders.

The trader will use trend lines, oscillators, and visual identification to determine the type of market that the price action is presenting. Strategies in a flat, ranging, or trending market are bound to contrast strongly with each other, and it is not possible to identify a useful strategy without first filtering the tools on the basis of the market’s character. Once this is done, and the time frame of the trade is determined, the second stage is -

2. Picking the right technical tools

We must pick the appropriate technical tools for the chart we examine. If the market is trending, there’s little point to using the RSI. If it’s ranging, the moving averages are unlikely to be of much use. If it is highly volatile, smoothing out the fluctuations with moving average crossovers could be very beneficial for identifying the trend.

3. Seek the signals

Once the technical tools are setup, we must now seek the signals that will show us the trade opportunities created by investor sentiment and temporary imbalances in the supply and demand for a currency pair. The signals that we seek are the ones created by the interaction between a number of indicators, such as that between moving averages, various oscillators, or between the price and the indicator. Our purpose is to confirm our ideas with various aspects of technical analysis. If there’s an oversold or overbough level, we will confirm it with a divergence/convergence. If there’s a breakout, we will seek to ascertain it with studies of crossovers.

4. Perform the analysis

After deciding on the signals and their meaning, we will perform our analysis by identifying actionable signals, and deciding on capital allocation in light of proper money management techniques. When analyzing the data we must make our utmost exertion to ensure that we focus on signals relevant to our selected period and trading plan.

5. Compare the results, execute the trade

After examining the various scenarios presented by the charts, and determining on which of them are actionable, the trader will compare them in terms of credibility and profit potential (for example, how extreme are the indicator values, how much profit or loss will be generated in case a take- profit or stop-loss order is realized?) Once that is done, he will pick the trade that offers the highest returns with the lowest risk on the basis of the technical scenario.

Forex Technical Analysis Indicators

1. Forex Strategies Based on the Moving Averages Indicator

One of the most popular trading strategies is based on the technical indicator called moving averages. Moving averages are calculated by taking the price of currency and calculating the average price over different periods. Traders use a number of moving averages on a chart to gauge the trend in the market and to make buy and sell decisions based on where these moving averages cross over one another.

Moving averages are often used in conjunction with other indicators to confirm trends and to ensure profitable trades. The following image shows the EUR/USD Forex Pair with two moving averages on the chart. Where the moving averages cross indicate a buy or sell signal and the moving averages also represent a trending market.

Forex Strategies Based on Bollinger Bands

The Bollinger Bands is a technical indicator that was developed by John Bollinger in the 1980’s. This indicator is often used by traders to decide when to buy or sell Forex. Bollinger bands are used to filter price action to gather information about the current trend of an instrument within the market. Bollinger bands are created using an exponential moving average and then creating upper and lower price channels above and below the center line.

This is what a Bollinger band looks like on a chart:

The light blue line represents the center line. The dark blue line is the upper Bollinger Band and the lower purple line represents the lower Bollinger Band.

Forex Strategies Based on Candlestick Formations

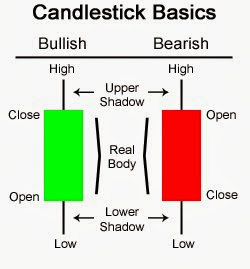

Candlesticks were developed by the Japanese in the seventeenth century to help them with their rice trading. They developed a way of visually representing the price action of an instrument to represent what had happened during that period. Each candlestick represents the high, low, and closing price of the instrument for that period of trading.

A candlestick is formed by representing these elements in a bar formation. This is what candlesticks looks like on a chart:

Each candlestick has a body and two tails, one above the body and one below the body. The color of the candlestick represents whether the price closed above or below the opening price.

Traders use candlesticks and specific candlestick patterns to gain information about the market sentiment of a pair to decide if the pair should be bought or sold.

Thank You !